Your charitable contributions have to comply with federal tax regulations built to avoid poor deductions. Turbotax provides a Software, ItsDeductible, which allows you figure out if a donation qualifies being a deductible contribution and how much you'll be able to deduct.

A civil defense Corporation developed less than neighborhood, state, or federal regulation, including any unreimbursed expenditures of civil defense volunteers which can be immediately connected to their volunteer companies

So how can we make money? Our associates compensate us. this could influence which merchandise we evaluation and compose about (and where by People products show up on the location), nonetheless it by no means has an effect on our tips or guidance, which happen to be grounded in Countless hrs of study.

build your history-keeping program at the start of yearly and file all donation receipts in exactly the same position. acquiring a receipt whenever you donate strengthens your tax information in the event you are audited.

Observe: This deduction is not really readily available if someone taxpayer opts to pay for taxes underneath the new tax routine (115BAC).

We feel Everybody really should have the ability to make financial conclusions with self esteem. And whilst our web-site doesn’t element just about every organization or monetary merchandise readily Review available on the market, we’re happy the guidance we provide, the data we offer along with the instruments we generate are goal, unbiased, easy — and free.

A lender record for instance a canceled Check out or statement that displays the identify of the experienced Group, the date from the contribution, and the level of the contribution

When you've got tax carryforwards, keep track of them carefully, so that you make use of them up ahead of expiration. If it looks as if you’re vulnerable to losing a balance carryforward, contemplate holding again on The existing yr’s donations and making use of up the older kinds . in any other case, you may drop a deduction once you hit the five-year limit.

Kemberley Washington is actually a tax journalist and supplies buyer-helpful tax recommendations for people and companies. Her do the job goes further than tax content articles. She has become instrumental in tax merchandise evaluations and on-line tax calculators to aid persons make i...

Here's much more on what kind of donations are tax-deductible, and the way to assert a deduction for charitable contributions.

the brink difficulty for many taxpayers is deciding if your itemized deductions—such as charitable contributions—will cause higher tax savings than proclaiming the normal deduction.

Student loans guidePaying for collegeFAFSA and federal pupil aidPaying for job trainingPaying for graduate schoolBest non-public pupil loansRepaying university student debtRefinancing university student debt

considering your tax technique? Don't miss out on charitable deductions. check out our charitable tax Heart to have more knowledge and insight. Explore now.

when you've decided to give to charity, consider these measures if you intend to take your charitable deduction:

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Kel Mitchell Then & Now!

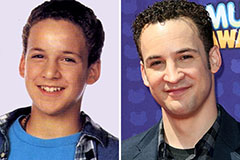

Kel Mitchell Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!